Follow me on LinkedIn

Two huge events shook the world of marketing technology last week and demonstrated the continued determination to harness marketing data to improve marketing and sales processes.

On Monday, October 6th, Infusionsoft―makers of marketing automation software serving the small business sector―announced a new $55 million round of funding headed by Bain Capital and Goldman Sachs.

Then on Thursday October 9th, Hubspot went public, raising $125 million in its flotation and becoming the 3rd marketing automation IPO. Eloqua went public in August 2012, raising $92 million, before it was promptly purchased by Oracle in December of that year for $811 million. Then in May of 2013, Marketo went public, raising nearly $80 million.

Infusionsoft's fourth round of financing caps a record year for VC funding in the marketing automation sector.

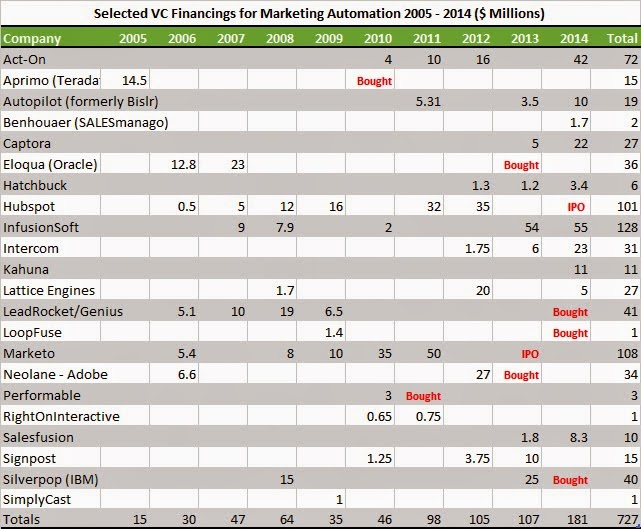

Below is a chart of selected VC financings for marketing automation related ventures.

In addition to IPOs and venture funding, there’s also been a rash of acquisitions.

Between venture funding, IPOs and acquisitions, no one can argue that marketing automation is not hot.

But what’s behind this level of activity?

Advertising, and more generally marketing, has been in the throes of transformation for decades, or what the economist Joseph Schumpeter called ‘creative destruction’. To understand the transformation taking place, try to image marketing before Social Media, before Google, even before email and the Internet. Content was largely created by a few big ad agencies (think Don Draper) and pushed to consumers. Of course we still have ad agencies doing big TV campaigns but that’s far from the full story. The Internet browser—Mosaic was the first—made content available to the masses and also spurred a content revolution.

With content vastly more accessible, a virtuous cycle of content creation and sharing was born. And it’s the exponential growth in content that is at the heart of the rise of marketing. Google (and its predecessors) have transformed marketing from what was largely a top down, indiscriminate, push of content from a few large agencies, to a much more efficient, bottom up, pull from hundreds of millions of consumers via Internet search. That’s how Google has gone from start-up in 1998 to a $400 billion company in a mere 16 years. Of course we still push content, but at a fraction of the cost through Internet advertising and email marketing, and it’s aimed at intricate demographic and behavioral segments, and individuals that are far more likely to purchase.

The vast bulk of content today is created bottom-up, through websites, blogs, and, of course, social platforms. Add to the proliferation of content, the exponential growth in digital interactions, and now marketing has become more data intensive than Wall Street—hence the acquisition of marketing software firms by tech giants like IBM, Oracle, Microsoft and Adobe.

The transformation of marketing is represented both by meteoric rise in content and the ability of marketers to interact with that content. The primary challenge of marketing today—and the focus of many of today’s marketing technology firms—is managing the proliferation of content and interactions, and harnessing this data to put relevant content in the hands of customers and prospects so that products can sell themselves, or, in the case of B2B, at least do the bulk of the selling work before a hand-off to sales is made.

Software-as-a-Service (Saas), aka Cloud Computing

There’s another important factor at play in the rise of marketing; the coming of age of Software-as-a-Service (Saas) or cloud computing. SaaS made it far less costly to start new software ventures, and much cheaper (and less risky) for business users to purchase software. The IT department used to hold enormous sway over software investment dollars. Not so with cloud computing. The combination of vastly increased supply of software products and the release of purchasing power from IT to the marketing department resulted in rapid innovation and a burgeoning marketing for marketing technologies.

At the nexus of data, content, and technology is the sector known as Marketing Automation and it’s gone from red to white hot. Marketing Automation deals with functionality such as streamlining content creation, distributing across multiple channels, attracting web surfers, capturing leads, segmenting prospects, quantifying and responding to digital interactions, etc. To the extent that marketing technology firms can help marketers in this gargantuan effort, they will continue to thrive.